If your company resides in the US or Europe, you’re probably aware of the legislation surrounding the Prompt Payment Act or Payment Practice. Now, more than ever, it’s important that you understand what regulations and offerings have emerged due to the pandemic.

Depending on your industry and regulatory bodies, companies, contractors, and vendors may have come to a special agreement in light of the Covid-19 outbreak.

However, it’s crucial you understand the regulations as they can be complex. Failure to correctly adhere to them can lead to significant legal consequences. Unsurprisingly, 61% of respondents in a Levvel survey reported that their top contract management challenge was the government, legal, or corporate compliance.

Depending on the location of your vendors or contractors, there are varying interest rates that come into play when you pay them late. You could even be caught up paying legal and court costs if the case is escalated. The situation can turn into a real headache that drains your organization’s precious resources, as well as damaging your reputation.

Most people don’t realize the advantages an organization has when they automate their processes over those who don’t. To ensure you avoid all the pain of late payment, let’s briefly evaluated the Prompt Payment Act and Payment Practice rules in the US, UK, and Ireland, and how to gain an upper hand.

What is Prompt Payment?

Throughout the US, the Prompt Payment Act’s regulations vary. Differences also arise when it comes to private and public contracts. Let’s delve into private payments first.

Private

Fees and penalties for late payment or withholding payment are vastly different state to state. Interest rates are also outlined on either a yearly or monthly basis depending on the location.

For example, there’s no specification in Iowa when it comes to late payment or the set number of days to pay within the approval of an invoice. However, in Delaware, you could face up to 5% in accrue interest every month that the payment isn’t received. Additionally, you could be paying court and attorney fees for the prevailing party.

Furthermore, in Florida, current judgment rates dictate the level of interest a company will have to pay. Attorney’s fees are generally awarded to the prevailing party too. So, understanding your state’s legislation is critical to your business.

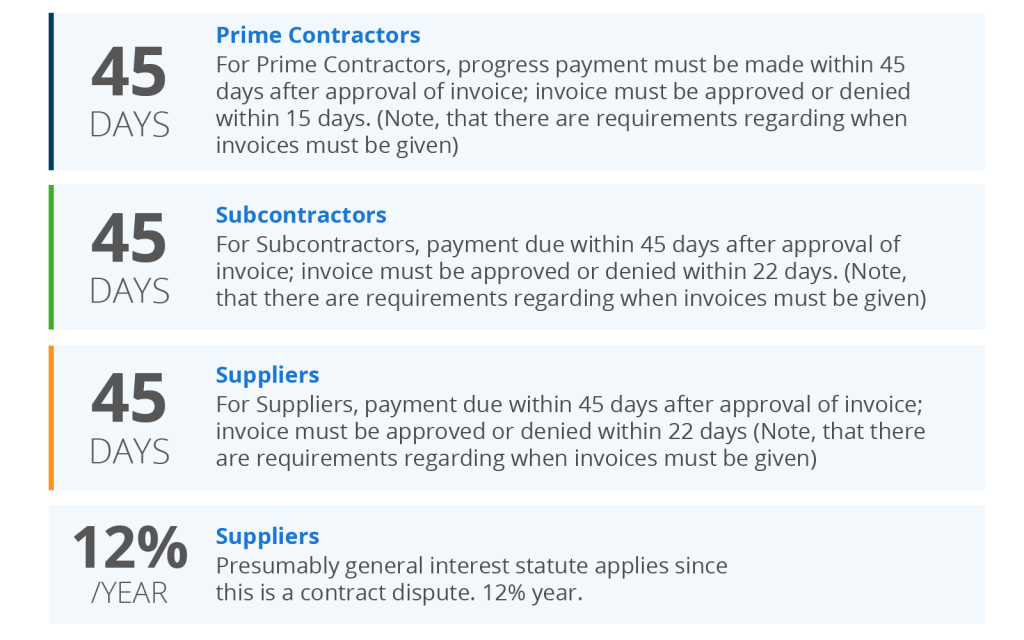

The days in which an invoice must be paid can also vary under the Prompt Payment Act. It’s 45 days in Massachusetts, for example, or just five days in Arkansas. Approval or denial of invoices should take place in a shorter time period, according to regulations. It will be dependent on whether the invoice came from a subcontractor, prime contractor, or vendor. Keeping track of so many variables is challenging in a manual process as it requires staff to know and remember the legislation in each state, as well as keeping track of an invoice within their approval system.

Public

Public entities across the US will also have different obligations determined by their dwelling.

Unlike private contracts, in Iowa, vendor invoices must be paid within certain terms by public offices. In Massachusetts, the time is sliced from approval to payment, with public projects paying prime contractors in 15 days, and subcontractors and suppliers receiving payment within 37. Generally, interest and fees are lower for public bodies than private. However, there are states, such as Kansas, that make no difference between the two, and both must follow the same rules.

Curious to see your state’s legislation? This website has all the information you need.

Payment Practice in the United Kingdom

Since April 2017, the law requires larger UK companies to publicly release their payment policies, practices, and performance in a report, twice a year. The regulations were introduced with the intention of helping smaller and medium suppliers receive their payments on time.

As of 2019, companies with a turnover of £36 million annually, £18 million balance sheet total and 250 employees will have to submit the report, irrespective of if they’re private, public, quotes companies or LLPs.

The Reporting

The first report should be delivered within 30 days after the company’s first six months into the financial year. It must also align with key business reporting dates for the company.

The second report should be submitted within 30 days after a company hits the end of its financial year. The report looks for statistics such as the average number of days taken to make payments in the reporting period.

Other metrics include “the percentages of payment due within the reporting period, which were not paid within the agreed payment period, and the percentage of payments made within the reporting period, which were paid in 30 days or fewer, between 31 and 60 days, and in 61 days or longer.”

For the full list of requirements, please see this document.

The Prompt Payment Act in Ireland

In Ireland, regulations exist under a 1997 Act, which was later updated at a European level in 2012. They apply to both the public and private sectors.

Under the Prompt Payment Act, interest and compensation are automatically given on commercial transactions that are paid late. Since January 1 of this year, the late interest rate on payments is 8.00% per annum. That equates to a daily rate of 0.0022%.

The law will protect suppliers, even if the payment date isn’t specified in the contract on certain grounds. For the full regulations, click here.

Public

Since June 2009, government departments, the HSE, local authorities, and all other public sectors (excluding commercial Semi-State bodies) in the Republic of Ireland have 15 calendar days of receipt of a valid invoice to make payment. For more information on the guidelines, click here.

Gain the upper hand

Automating your Procure-to-Pay process will ensure you never miss a payment deadline, including special deals that have been established during this time of uncertainty.

In a manual process, it’s up to the departments to track payment deadlines and to ensure it honors their payment agreement. Accounts Payable are responsible for chasing, checking and paying it on time. This allows room for human error and potential problems.

During the invoice approval process, invoices can go missing or it could be on someone’s table back in the office when everyone is now working remotely. These types of delays slow down the process considerably and can lead to a late payment.

However, an automated system will heed the deadlines you set for approval on invoices and any amendments you make in light of the recent circumstances. Robotic Process Automation (RPA) technology will request approval again if the approver has failed to do so, at any initial stages. If the invoice still doesn’t get approved, RPA will then re-route to the invoice to another pre-configured approver, if such instructions have been set. To learn more about RPA, read our blog here.

In automation, the system will prompt you when contracts are up for renewal, payments can be set up to go automatically and they can be configured amounts in line with your contractual agreement. Automation makes it much easier to keep track and stay compliant, so you aren’t hit with legal costs and late fees. In fact, 78% of organizations reported improvements in compliance with corporate or government regulations. If you are now looking to downsize your contract portfolio, understanding penalty clauses for contract termination will be crucial. Having automation will allow you to review these clauses quickly and easily with visibility over all of your companies’ contracts, stored in one place.

Aligning Procurement and Accounts Payable through automation will allow stronger teamwork when you’re working from home to lower the risk of human error. Deadline payments can be set and approved by the appropriate people, leaving no room for interpretation or miscommunication.

According to a Levvel survey, late payments were the second-highest payment challenge. Once automation was implemented, companies recorded improved visibility into unpaid invoices and quicker approval of invoices. For more benefits of aligning Procurement and Accounts Payable, cast an eye over this blog.

Automation provides peace of mind that payments and outstanding invoices will be paid on time as they’re visible on one platform, throughout this time of unease. Master the Prompt Payment Act or Payment Practice and never fret about the legal implications that come with late payments.

Conclusion

Whether you are based in the US, UK, or Ireland, an automated solution works in coordination with your entire finance department to ensure compliance, even if they aren’t physically in the office. Stability is what everyone is craving and automation will provide that by giving you one platform, saving your organization time, reducing human error, and strengthening your relationship with your vendors.