Fully automate your entire procurement and accounts payable processes

Fully automate your entire procurement and accounts payable processes

SoftCo Procure-to-Pay automates your entire finance process from procurement to invoice automation and payment. SoftCo’s Procure-to-Pay software is truly global, handling multiple entities and multiple currencies in multiple languages. It eliminates maverick spending and delivers efficiencies, cost savings and 100% visibility & control over the entire procurement process. SoftCoAP processes all PO and non-PO supplier invoices electronically from capture and matching to invoice approval, exception handling, problem management and seamless integration to over 200 ERP’s. Incorporating unique AutoML Machine Learning technology, it delivers unparalleled touchless automation reducing the number of supplier invoices that need manual intervention. SoftCo leads the market with 90% straight through processing for PO invoices and 89% fast processing of Non-PO invoices. SoftCoPay transforms payments from a cost center to a profit center by optimizing payments, earning rebates, reducing costs and mitigating payment risk.

SoftCo Procure-to-Pay software eliminates manual and duplicate processes and provides you with visibility and control over your corporate spend and accruals enabling an accelerated month-end close. SoftCo Procure-to-Pay software boosts your vendor relationships by providing an efficient on-boarding process and full visibility over the status of their invoices. The solution enforces and optimizes pricing agreements with your preferred vendors. It also manages the request, purchase and control of contract-based spend. Agreed vendor contracts are securely compliantly stored and managed with automatic alerts for renewals and expirations of your contracts. SoftCo Procure-to-Pay software incorporates anti-fraud AI functionality that provides real-world fraud prevention while Advanced Analytics tracks all key trends improving the management of costs, performance and effectiveness of operations.

SoftCo’s unique Automated Machine Learning (AutoML) is a game-changer in automating both PO and Non-PO invoicing, with full transparency and auditability. Manual invoice processing can cost $16 per invoice, whereas high automation that is driven by AutoML reduces processing costs by over 90%. The results are unrivaled, and the savings are exceptional. SoftCo delivers 90% straight through processing for PO invoices and 89% faster processing of Non-PO invoices compared to manual environments. Smart Coding and Smart Routing utilize Machine Learning to automatically determine the correct routing and coding of invoices. Surcharge processing is automated regardless of the way in which they are presented, reducing the time to process by 95%. SoftCo Exception Handling ensures the AP team are fast tracked directly to the exact issue which is processed.

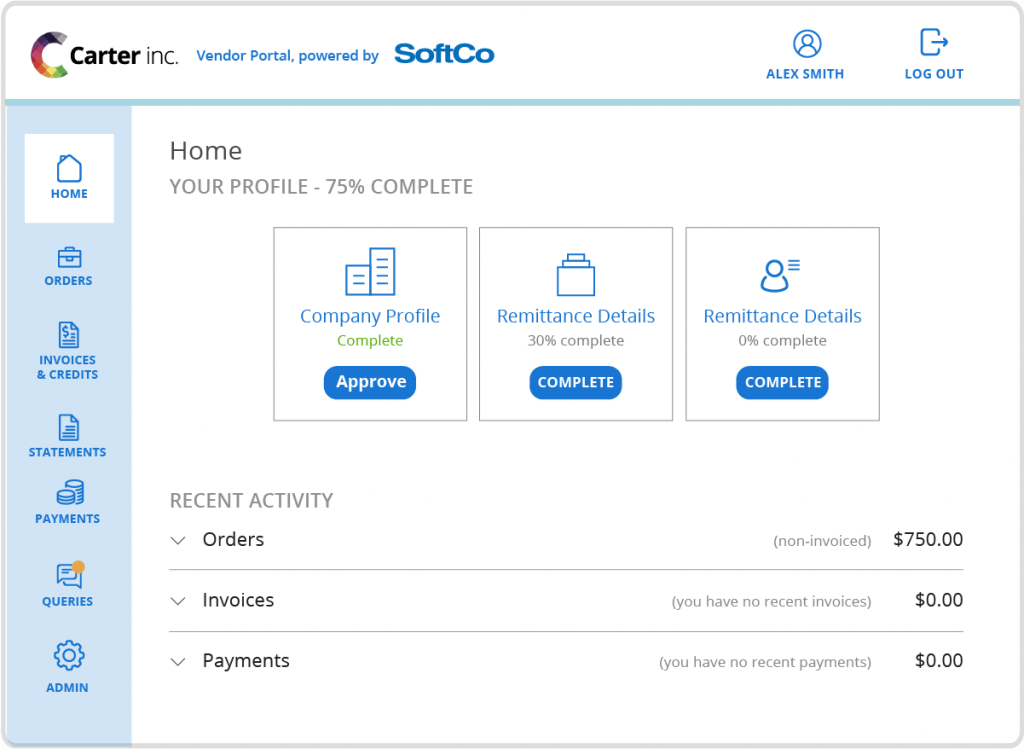

SoftCo Vendor Management delivers the benefits of working efficiently with preferred Vendors. Purchasing is optimized, costs reduced, and administration is eliminated. The cloud-based solution ensures Vendors have full online visibility of all orders and invoices and queries and disputes are addressed immediately.

Using Machine Learning, SoftCo Smart Coding reduces the processing time of non-PO invoice handling by 89%, with industry leading compliance and audit checks. SoftCo Smart Coding intelligently identifies and learns coding patterns of previously coded invoices allowing it to automatically code invoices, with just one click. This innovative feature significantly reduces the reliance on the AP team’s knowledge and enables coding in seconds rather than minutes.

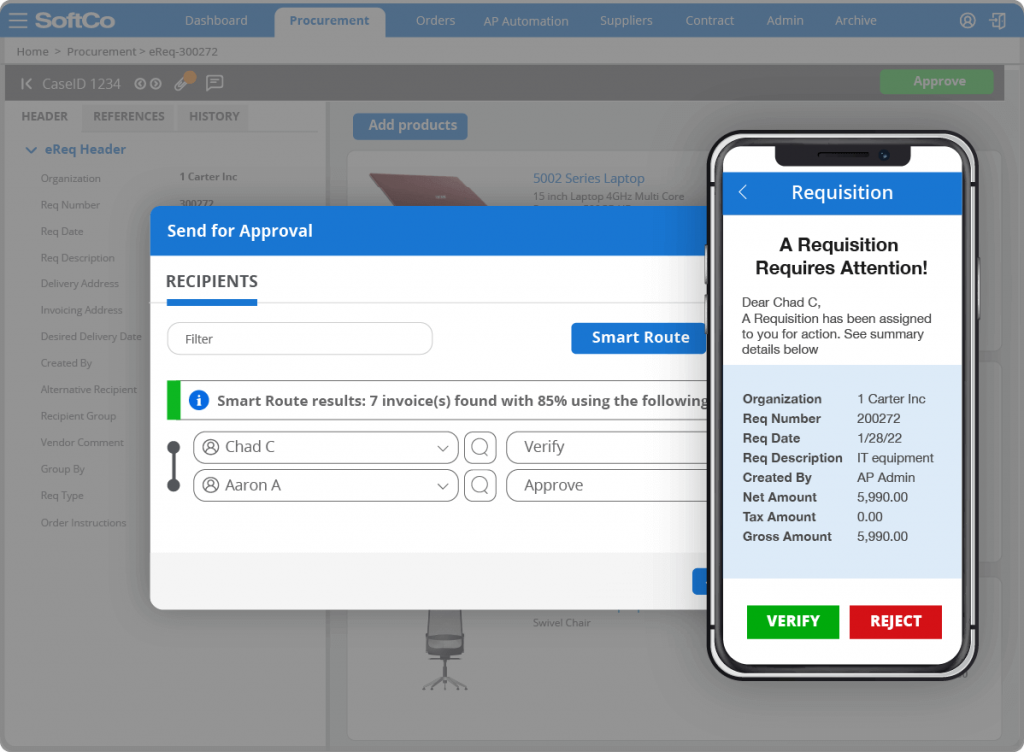

SoftCo eProcurement (electronic procurement software) ensures a quick and efficient purchasing process for all operational spend, in full compliance with your organization’s procurement policies. SoftCo eProcurement software streamlines capital, recurring and operational spend.

Smart Routing uses Machine Learning to determine the correct routing of invoices for approval, reducing the time taken to correctly route invoices by 90%. SoftCoAP delivers an accelerated, secure invoice approval process with configurable automated workflows. With multiple verifiers and approvers, invoices are routed for approval, automated email notifications are sent, followed by reminders. Un-actioned invoices are routed to an alternative approver, ensuring minimal process delay.

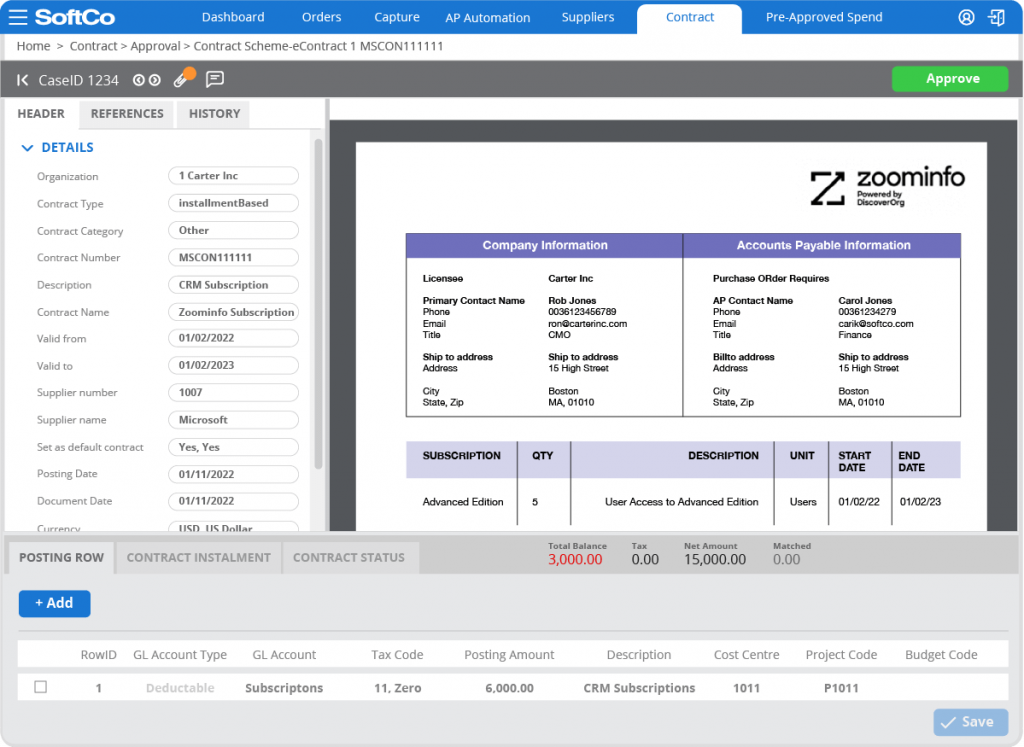

SoftCo Contract Compliance closely integrates with all SoftCo P2P modules. It manages the request, purchase and control of contract-based spend within eProcurement and facilitates contract and invoice matching within AP with comprehensive reports. The solution alerts you for contract expiry or renewals. All contracts and supporting information are stored in the SoftCo Compliant Archive.

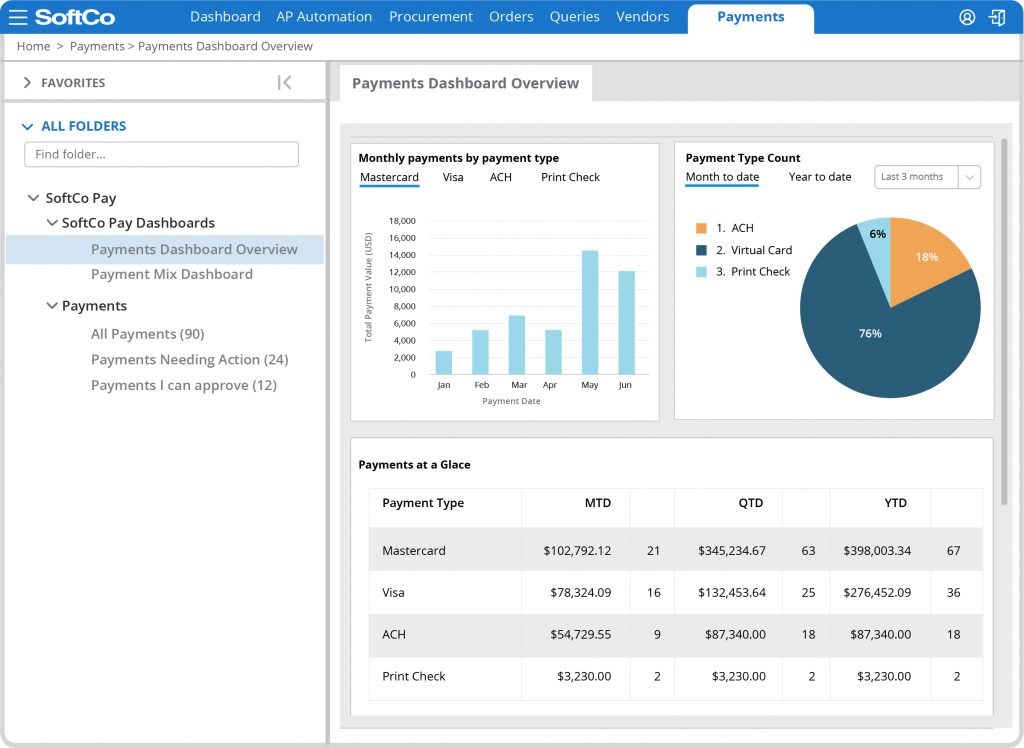

SoftCoPay transforms payments from a cost center to a profit center by reducing costs, earning rebates, mitigating payment risk, and optimizing payment type. Payments are streamlined into an easy to use workflow. The seamless process, from receipt of invoice to vendor payment, delivers control and transparency with straightforward reconciliation through your ERP and a fully auditable payment process.

SoftCo Accounts Payable Automation captures all invoice data, regardless of the format received from your Vendors, using advanced Data Capture technology or via SoftCo’s outsource data capture service. Processing times are improved, and keying errors eliminated.

SoftCo SmartConnect is a secure, highly configurable cloud-based platform which manages all of the data exchange between your ERP and SoftCo. SoftCo Procure to Pay has over 30 years’ experience integrating seamlessly with all major finance systems, databases, and over 200 ERP’s from the leading industry names to bespoke systems.

Smart Matching, powered by AutoML Machine Learning, removes manual elements of invoice matching, resulting in an industry-leading 90% touchless invoice processing. AutoML is a product of years of research and over 50 million matches. The SoftCo Smart Matching engine applies AutoML to even the most complicated matching scenarios, such as incomplete data, missing product codes, and FX conversions delivering unrivalled match rates and exceptional savings.

SoftCo delivers industry leading analytics to empower organizations to make informed decisions. SoftCoP2P offers both SoftCo Advanced Analytics, part of the SoftCo solution, and the ability to integrate with 3rd party analytics tools. The platform provides accurate, real-time information over AP productivity, invoice processing rates and payments performance.

“As the largest mobile top-up platform in the world it is key for us to remain competitive and receive true value from our suppliers. We have been able to achieve this with our partnership with SoftCo.“

Jonathan Rockett, Chief Financial Officer, Ding

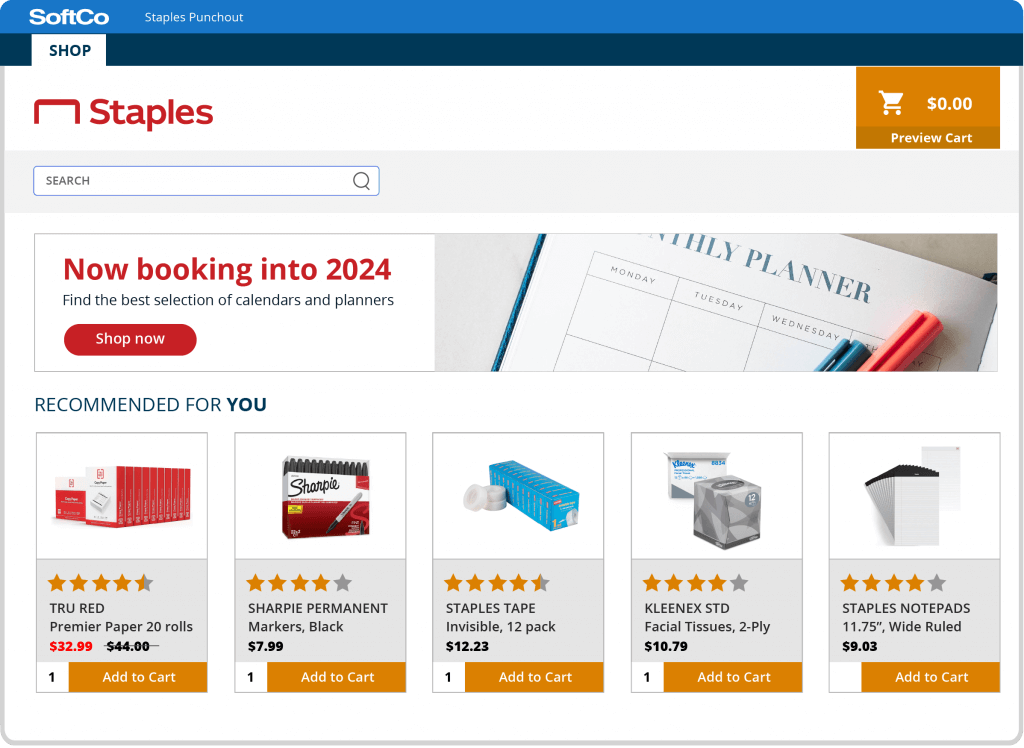

Organizations typically manage three different types of spend – capital spend, recurring spend and operational spend. SoftCo eProcurement software streamlines each of these spend categories.

Vendor catalogs and shopping lists are maintained, and the powerful vendor punch-out functionality allows the selection of products directly from your vendors’ website and population directly back into your SoftCo shopping cart. Requisition templates create re-usable shopping lists for continuous use.

SoftCo’s eProcurement solution’s pre-approved spend functionality allows seamless drawdown on pre-approved or capital budgets for projects with agreed preferred vendors. For recurring spend such as subscriptions, leasing, rent and utilities, SoftCo eProcurement software provides a contract PO to all vendors referencing the agreed installment or payment plan as per the agreed contract/subscription.

The dynamic matching engine handles 2-way and 3-way matching to match your invoice data to your purchase orders and goods receipt notes. SoftCo Smart Match applies AI-driven Machine Learning technology to even the most complicated matching scenarios, such as incomplete data, missing product codes, rounding issues and FX conversions, further improving straight through processing rates. SoftCo Accounts Payable Automation assigns your non-PO invoices to an automatic general ledger and cost center through posting templates that are associated with your vendors.

For your recurring invoices, such as subscriptions, leasing, rent and utilities, SoftCo Accounts Payable Automation automatically matches them to your underlying contract PO, and routes them for appropriate approval, without the need for supporting POs or GRNs.

SoftCo Vendor Management solution enhances relations with your key vendors with full online visibility of all orders and invoices and ensures queries and disputes are addressed immediately.

Vendors register on the SoftCo Vendor Management Portal, self-completing the on-boarding process by adding company and financial information and all supporting documentation, including payment and VAT/TAX data. The automated onboarding guarantees adherence to AML compliance and removes the need to chase vendors for vital information. Registered vendors add their own order and invoice transmission preferences and the SoftCo Vendor Management Portal enables paper-based vendors to submit invoices.

SoftCo Vendor Management enables preferred vendors to submit all invoices directly from the Portal as they receive purchase orders. ‘PO Flip’ converts received orders into a corresponding invoice that is returned to you immediately. Vendors are notified instantly when you submit a purchase order and track the progress of invoices submitted. There is no need to chase payments and administration is eliminated.

SoftCo Contract Compliance provides a SÄHKE2 certified central contract repository where all agreed contracts with your vendors are compliantly stored and managed and are instantaneously available for retrieval based on user permissions. All contracts are stored as password-protected PDFs, preventing unauthorized printing and saving of your contracts.

SoftCo Contract Compliance provides full contract lifecycle management and proactively sets reminders for your expiring contracts or those due for renewal. The solution works seamlessly with the SoftCo Procure to Pay software modules to configure installment plans ensuring you only receive accurate invoices from your vendors, as per your agreed contracts. SoftCo Contract Compliance presents comprehensive compliance reporting including reporting on exceptions, status, renewals, and any overcharges.

Both domestic and international payments are revolutionized with SoftCoPay via one single channel. By delivering a single payment file, multiple manual processes are consolidated into one secure and efficient process, lowering costs and removing the risk of fraud and error.

SoftCoPay, through our payment partner Corpay, has a network of over 3.8 million vendors and work to continuously move vendors from expensive check payments to more cost effective, faster digital payments that drives down costs and earns you rebates.

Date: Tuesday, April 23rd, 2024

SoftCo's Brian Bertges and Jason Hery discuss the importance of Accounts Payable Automation

Inefficient accounts payable practices result in late payments and lack of visibility which hurt your business….